Follow Us

- BJP hijacked Nitish Kumar, CM is in an unconscious state:Tejashwi Yadav

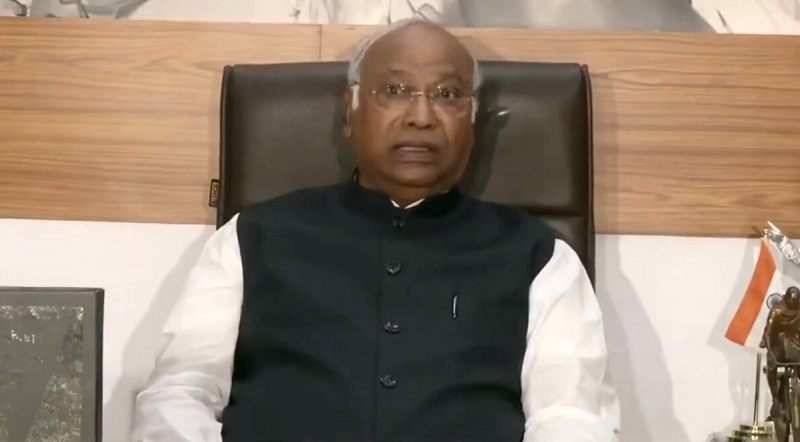

- BJP-RSS People Are Enemies of Babasaheb Ambedkar: Kharge

- BJP-RSS were enemies of Babasaheb then and still now: Kharge

- Daniel Noboa elected president of Ecuador

- 56 killed by paramilitary forces in Sudan's western city in 2 days: Reports

Finance Minister Sitharaman tables new Income Tax bill in Lok Sabha

The legislation will replace the Income Tax Act, 1961, which has undergone extensive modifications over the past six decades.

The bill will be sent to the Select Committee of Parliament before being presented for final approval. The new law is expected to take effect on April 1, 2026.

The primary objective of the new Income Tax Bill is to simplify tax laws, making them more transparent, easier to interpret, and taxpayer-friendly. By replacing complex provisions with clearer language, it aims to reduce legal disputes and encourage voluntary tax compliance.

The bill may introduce lower penalties for certain offences, making the tax system more accommodating for taxpayers.

The new bill also introduces explicit provisions for virtual digital assets and updates beneficial tax rates. This ensures that digital assets, such as cryptocurrency, are covered under a proper tax framework.

The bill will not alter existing tax slabs or revise the tax rebate structure. Instead, it focuses on making the six-decade-old legislation more user-friendly.

“This reform is a significant step toward modernizing India’s tax framework, bringing greater clarity and efficiency. The bill promises a more streamlined, accessible tax system, making it easier for citizens and businesses to fulfill their obligations while fostering trust in the system,” said Rohinton Sidhwa, Partner, Deloitte India.

The first part of the Budget Session of Parliament concluded on Thursday, with the second part scheduled to resume on March 10. The session is being held in two phases—January 31 to February 13 and March 10 to April 4.

People Of India Are being Looted By Govt, Emptying People's Pockets: Congress

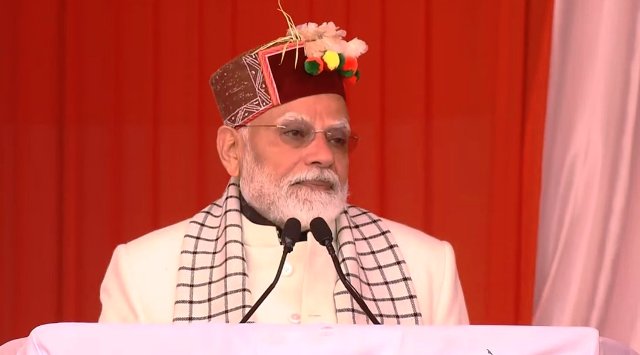

Modi govt destroyed domestic investment, annihilated FDI: Congress

Do We Have to Chant 'Jai Shri Ram' Three Times a Day? : Mahua on Threats to Fish Sellers in Delhi's CR Park

Govt auctions 12 coal mines, projected to yield annual revenue of ?3,330 crore

Talcher Fertiliser Project construction completed by around 60 per cent by February end: Minister

-

BJP-RSS People Are Enemies of Babasaheb Ambedkar: Kharge -

.jpg)

56 killed by paramilitary forces in Sudan's western city in 2 days: Reports -

.jpg)

Congress Again Targets Modi Government Over RTI Law, Jairam Ramesh Urges To Repeal Weakening Amendments -

.jpg)

Gaza death toll crosses over 50,950 as Israeli army kills 20 more Palestinians -

.jpg)

Fugitive businessman Mehul Choksi, accused in PNB scam, arrested in Belgium -

At least 8 Workers Killed,7 Injured in Firecracker Factory Explosion in Andhra Pradesh -

Over 20 killed in Russian missile attack on Ukraine's Sumy -

Modi govt destroyed domestic investment, annihilated FDI: Congress -

Talcher: Thousands throng to witness Maa Hingula Yatra -

Bihar: Tejashwi Yadav attacks Nitish Kumar, says - Government of criminals, for criminals -

.jpg)

Three historic resolutions to strengthen social justice by Congress, says Rahul Gandhi -

.jpg)

Do We Have to Chant 'Jai Shri Ram' Three Times a Day? : Mahua on Threats to Fish Sellers in Delhi's CR Park -

Congress's nationalism unites the country, BJP's nationalism divides it : Pilot -

.jpg)

Patel was against RSS ideology, claims by Sangh on his legacy laughable : Mallikarjun Kharge -

After Waqf, RSS now eyes on church lands : Rahul Gandhi

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)