Follow Us

- 13 killed as bus plunged into ravine in Colombia

- Gaza death toll crosses 45,700 as Israel kills 59 more Palestinians in the last 24 hours

- Death toll rises to 15 in New Orleans pickup truck attack

- Gaza death toll reaches near 45,600 from Israel attacks

- Modi government 'stealing' mangalsutras of women : Jairam Ramesh

India's manufacturing growth hits 12-month low in December

The seasonally adjusted HSBC India Manufacturing Purchasing Managers' Index was at 56.4 in December, down from 56.5 in November, indicating a weaker improvement in operating conditions.

Despite the decline, the headline figure remained above its long-run average of 54.1 thereby signalling a robust rate of growth.

In PMI parlance, a print above 50 means expansion, while a score below 50 denotes contraction.

"India's manufacturing activity ended a strong 2024 with a soft note amidst more signs of a slowing trend, albeit moderate, in the industrial sector. The rate of expansion in new orders was the slowest in the year, suggesting weaker growth in future production," Ines Lam, Economist at HSBC, said.

The manufacturing sector growth was hampered by competition and price pressures.

Lam said there was some uplift in the growth of new export orders, which rose at the fastest pace since July.

"Although new export sales rose at a slower rate than total new business, the pace of growth for the former strengthened as firms were able to secure international orders from across the globe," the survey said.

Ongoing improvements in new work intakes prompted manufacturing companies in India to purchase additional inputs for use in production processes and on the job front, around one in ten companies recruited extra staff, while fewer than 2 per cent of firms shed jobs.

On the price front, with container, material and labour costs reportedly rising since November, Indian manufacturers registered another increase in overall expenses. On a month-on-month basis, however, the rate of input price inflation was moderate by historical standards.

The HSBC India Manufacturing PMI is compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 400 manufacturers.

Looking to 2025, Indian manufacturers were confident of a rise in output. "Optimism reflected advertising, investment and expectation of favourable demand. Sentiment was nevertheless curbed by concerns around inflation and competitive pressures," the survey said.

Rupee 58.58 against dollar in 2014, It's 85.27 now : Congress recalls Modi's 2013 remarks on currency during UPA rule

Bangladesh's forex reserves dip to 18.61 bln USD

India’s Forex Reserves Fall by $3.23 Billion to $654.86 Billion: RBI

RBI increases collateral-free agricultural loan limit from Rs 1.6 to Rs 2 lakh

U.S. stocks dropped as a hotter producer price index (PPI) overshadowed

-

.jpg)

13 killed as bus plunged into ravine in Colombia -

.jpg)

Gaza death toll crosses 45,700 as Israel kills 59 more Palestinians in the last 24 hours -

.jpg)

Death toll rises to 15 in New Orleans pickup truck attack -

Modi government 'stealing' mangalsutras of women : Jairam Ramesh -

.jpg)

India's manufacturing growth hits 12-month low in December -

15 killed,30 hurt as truck plows into crowd in New Orleans French Quarter -

Congress Leader Pawan Khera Slams Kejriwal Over \Pujari Granthi Samman Yojana' -

.jpg)

Ukraine vows to keep fighting amid potential U.S. aid suspension -

At least 66 killed in Ethiopia traffic accident -

179 passengers dead in South Korea plane crash -

Former U.S. President Jimmy Carter dies at 100 -

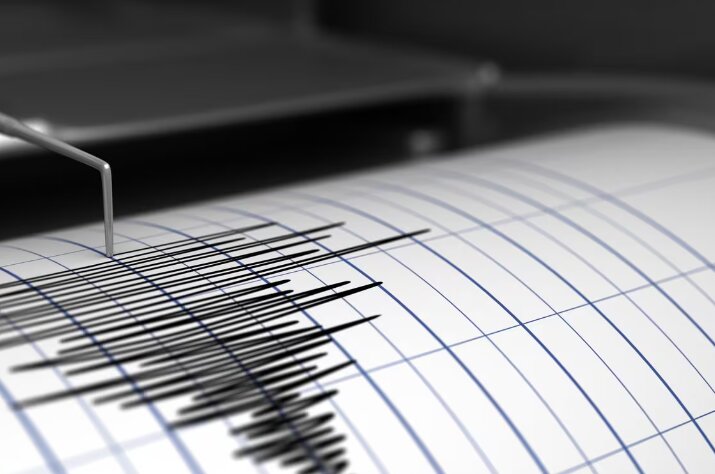

9 minor earthquakes rattle Greek capital -

Gaza death toll nears 45,500 as Israel kills 48 more Palestinians -

.jpg)

Naini Coal Block : Chhendipada villagers oppose massive tree felling by Singareni Coal Company -

.jpg)

FIR against Rahul is a symbol of govt’s desperation: Priyanka Gandhi Vadra

Sports

-

IND vs AUS 3rd Test: Rain disrupts first day’s match of Border-Gavaskar Trophy, forcing early draw of stumps for the day -

BWF World Tour Finals 2024: Treesa Jolly and Gayatri Gopichand lose opening Women’s Doubles Group A match -

Odisha Masters 2024: Manav Choudhary defeats Mohammed Munawar in Men’s Singles Qualification Round

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)