Follow Us

Breaking News

- Angul youth held on the charge of rape

- Five killed in fresh violence in Manipur's Jiribam day after rocket attack in Bishnupur district

- NTPC Talcher Kaniha Receives 2024 Energy Management Insight Award from Clean Energy Ministerial

- Rajasthan: Under-construction two-storey building collapses, many feared trapped under debris

- Jharkhand cabinet to waive power dues of Rs 3,584 cr of 39.44 lakh consumers

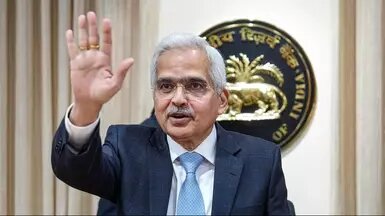

RBI keeps repo rate unchanged at 6.5 percent

New Delhi, Oct 6:-- The Reserve Bank of India (RBI) Governor Shaktikanta Das today announced that the monetary policy committee (MPC) has decided unanimously to keep the policy repo rate unchanged at 6.50 per cent.

The Monetary Policy Committee (MPC) met on 4th, 5th and 6th October 2023. As per a statement issued by the RBI today, after a detailed assessment of the evolving macroeconomic and financial developments and the outlook, it decided unanimously to keep the policy repo rate unchanged fourth time in a row.

Consequently, the standing deposit facility (SDF) rate remains at 6.25 percent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

The statement mentioned that the headline inflation had surged in July driven by tomato and other vegetable prices. The statement added that it corrected partly in August, and is expected to see further easing in September on the back of moderation in these prices. It further added that a silver lining amidst all these is declining core inflation, i.e., CPI excluding food and fuel. It further said, the overall inflation outlook, however, is clouded by uncertainties from the fall in kharif sowing for key crops like pulses and oilseeds, low reservoir levels, and volatile global food and energy prices.

As per the statement issued by the RBI, the real GDP growth for 2023-24 is projected at 6.5 per cent with Q2 at 6.5 per cent; Q3 at 6.0 per cent; and Q4 at 5.7 per cent. It added the the risks are evenly balanced and the real GDP growth for Q1:2024-25 is projected at 6.6 per cent.

The statement also mentioned that the MPC remains highly alert and prepared to undertake timely policy measures, as may be necessary, in order to align inflation to the target and anchor inflation expectations.

Related Business News

NTPC Talcher Kaniha Receives 2024 Energy Management Insight Award from Clean Energy Ministerial

ANGUL:NTPC Talcher Kaniha has been honored with the prestigious 2024 Energy Management Insight Award from the Clean Energy Ministerial (CEM), a global forum comprising 29 member governments and 21 participating countries dedicated to advancing clean energy policies and technologies. The statio....

India's first grain ATM launched in Odisha

BHUBANESWAR: Odisha's Food Minister Krishna Chandra Patra launched a first ever it’s kind of Annapurti ATM on August 8 in the presence of Nozomi Hashimoto, Deputy Country Director of World Food Distribution Event in India.

RBI maintains GDP growth at 7.2 pc; cautions on global challenges

NEW DELHI:Maintaining its stance on projected economic growth at 7.2 per cent for the fiscal 2024-25, the Reserve Bank of India (RBI) on Thursday said domestic economic activity continues to be resilient, but spillovers from protracted geopolitical tensions, volatility in international financi....

Speakers extend full support two Washery Plant at Talcher

TALCHER:All the speakers at the public hearing meeting of the expansion project of K R Enterprising supported the upcoming project with some demands for employment,plantation and health services. K R Enterprising which is having 2.4 million tone per annum coal crushing and screening plan....

Apple posts record 2nd-quarter sales with gains in iPad

Apple posted record second-quarter sales, with strong gains for the iPad and services, according to its financial results statement released Thursday.

The US-based tech firm posted total net sales of almost $85.8 billion in its fiscal 2024 third quarter ended June 29, which corresponds t....

Top News

-

Angul youth held on the charge of rape -

.jpg)

Five killed in fresh violence in Manipur's Jiribam day after rocket attack in Bishnupur district -

Rajasthan: Under-construction two-storey building collapses, many feared trapped under debris -

PM Modi's 'billionaire Raj' is more unequal than British Raj : Jairam Ramesh -

Modi government has failed to curb crimes against women : Kharge -

Typhoon Shanshan makes landfall in Japan's Kagoshima -

3 militants killed in LoC near Kupwara in J&K -

Two Angul labourers died of suffocation in septic tank -

Cong MLA accuses BJP of Rs 100 cr bribery plot to topple Karnataka govt -

Gaza death toll crosses 40,300 as Israeli forces kill 69 more Palestinians -

Telegram founder Durov arrested at French airport -

.jpg)

Congress Leader Hits Back Mohan Majhi Over Kashmir,Mocks Him As Teleprompter CM -

Volcanic eruption begins in Iceland -

Harris accepts nomination for presidential nominee at DNC -

Venezuelan court validates presidential election results

Fast Mail Spotlight

© 2024 Fast Mail Media Pvt Ltd. All Rights Reserved.

Powered by : FM Media Pvt Ltd.

Developed by : Futuradept Tech

.jpg)

.jpg)

.jpg)

.jpg)